Discover more from Dragon's Den Investing

My initial instinct was to jump right back into the corporate world – utilize the bitter feelings of being let go as motivation to join a competitor and exact retribution on a company by who I thought I had been wronged. Fortunately, this feeling was temporary, and I came to see the unexpected career setback as an opportunity to re-evaluate a new path forward. The first step was to consider what basic goals I hope to accomplish at this stage of life.

Current Stage Goals:

1. Pursue a passion

2. Be a present father and husband

3. Have control over my own time

4. Become financially independent

5. Success scales non-linearly with time invested

Confronting Failure:

When any large company goes through massive layoffs there are bound to be those considered “collateral damage,” by which I mean are perceived to be undeserving to be let go. For a while I thought of myself this way, after all it was what everyone told me, and it was the easiest way to move on while avoiding feelings of inadequacy. Upon reflection I concluded that contrary to this belief I had been let go because I lost passion for my job, and more importantly for the corporate lifestyle.

It might be odd to think someone can be passionate for corporate life, yet in my first 3 years at Intel I really was. It wasn’t simply that I enjoyed being paid to work on technology and gaming (this was a true and important factor); but what drove success was a passion for presenting ideas and playing the corporate “game” of advancement.

Presenting Ideas – What got me most excited at Intel was finding solutions to problems that my own unique background as a former professional gamer with years of experience in China could provide. I loved building these ideas into presentations and getting a bunch of seemingly important people into a room to give them an elaborate and well-practiced display that would solve the issue at hand if only they all agreed to commit resources/decisions to my proposed actions. I took pleasure in leading the room and seeing the reactions whether positive or negative on people’s faces, and shifting tone or direction based on audience feedback to achieve my stated aim. Yet this became impossible to do during/after Covid, and over video calls the enjoyment I received from presenting went away almost completely. In the past three years I did a lot less presenting my ideas, and when I did it, I did so more poorly than I had in the past. Working hard became less rewarding and more of a drudgery. Therefore, less hard work was done.

Playing the Game – When I first started working at Intel, if there was a new executive/manager in our organization, I would set up coffee or lunch with them to introduce myself and share who I am and what I’ve contributed. After the transition to work from home, I could not be bothered to do this. Networking in person was fun and fulfilling – I felt like I was building real relationships with people that would endure over time. Networking through video calls felt so forced and fake, and slowly I did less of it. Of course it didn’t help that we had moved from California to Arizona and shortly thereafter Intel cancelled its shuttle program, so in person networking was nearly impossible. This past year our business group had a new vice-president who came in and was asked to do sweeping layoffs. I knew the right thing to do career-wise was to cultivate a relationship with him to protect myself from the coming storm, but ultimately I did not have passion for the game anymore and failed to do so.

Reading through the above, one might conclude that I simply need to find an in-office job. Yet paradoxically I have been happier personally working from home, while being unsatisfied professionally. Which is more important? At this stage of life, for the first time in my life, the personal outweighs the professional.

My learning from this self-examination is that going back into a large corporation can be a job for me to support my family, but it will not be a passion I am excited to pursue or a pursuit I am likely to excel at. I could find a new job that’s mostly onsite, but that would almost certainly require moving from our new home, a very long commute, and/or 50%+ travel time. This violates #2 and #3 of my current stage goals. Moreover, my experience tells me that pursuing a passion isn’t to be recreated, but is something to seize and temper as the motivation for that which one is most excited for comes into view.

Carpe Diem:

Determining one’s current passion is quite simple in my mind, mostly because I’ve changed pursuits so radically throughout my career. The harder part is figuring out what to do with it, or how to turn passion into concrete action (like a job or business). Passions come down to what pursuits one thinks about the minute details of with even a spare moment. The details someone who was merely interested in something would find ridiculous or boring.

How I knew I lost passion for corporate life is that I would avoid thinking about my job – my job felt like something to escape from in my free time. Perhaps most people do this, but for me my “jobs” have always been much more of an all-in type of endeavor, so I would gravitate towards thinking about the pursuit of it even in my free moments. I’ve attempted to change this because society/mentors tell me it’s unhealthy, but through many failed attempts I’ve concluded that it’s the way I’m wired, and I need to find something I’m passionate about to do as a job in order to be happy. If I’m miserable in my job, but enjoy my hobbies, it is a path to further escapism and failure in my job.

The Seven Ages of Man:

My current stage goals are significantly different than before I had a family of my own. There were changes in the passions pursued over the last 20 years, but all these pursuits were approached in a way that would not be possible with a family. It’s difficult to overstate how much having a child pushes you to confront the goals you have in life. Not just philosophically, but even more so practically because you just have less time. For most of my 20s and 30s I held the idea in mind that if I devoted myself completely to whatever I was doing, then I would be successful at it. I’ve come to the realization that if I want to be a significant part of my family’s life, it’s just not possible to be so maximalist. Therefore, a rethink of my operating model for deriving meaning and achieving success is required. This is why #2 (be a present husband and father) and #3 (have control over my own time) of my current stage goals are new to my model.

Connecting the Dots:

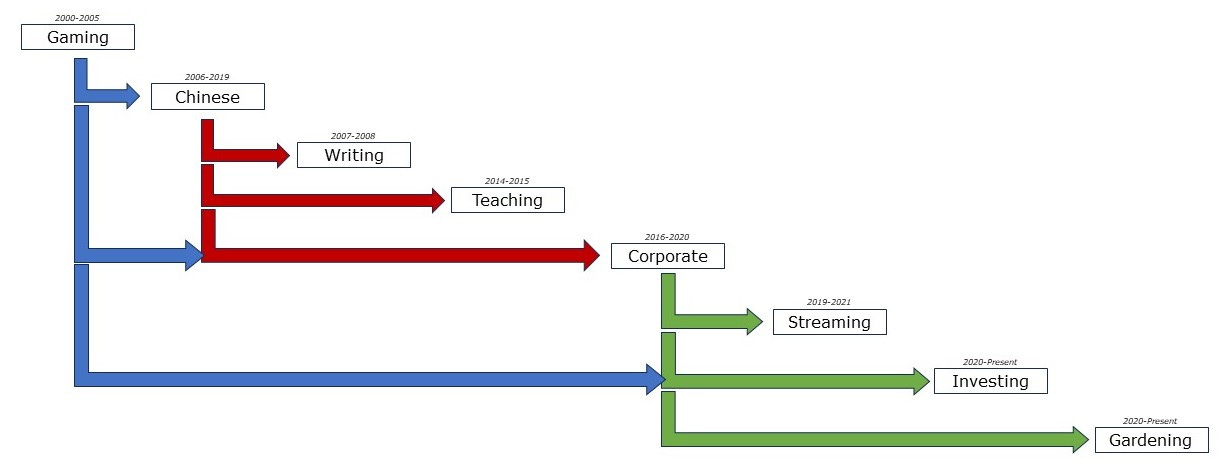

Looking back at the subjects I’ve been passionate about in adult life there have been three major themes.

1. Gaming

2. Chinese

3. Corporate

Each led to the next, and would not have come to fruition without experiencing the previous (e.g. I met a mentor who suggested I study Chinese while at a gaming tournament; I got into business school on the back of my experience in China, and a Michigan MBA led to Intel which would not have hired me if I did not have the experience of a professional gamer and doing business in China). Despite the passions being quite different, each utilized the skills formerly honed.

Within these major themes there were also sub-pursuits that were not fully realized, and as I think through my passions in life there are several that were done only temporarily. For instance, writing (during college), teaching (while at University of Shanghai for Science and Technology in 2014-2015), and game streaming (on Twitch and Douyu). Could any of these be my next job? I enjoy writing, but how to make money doing it? Teaching was incredibly fulfilling, but it does not scale irrespective of time invested (goal #5) or likely helps me gain financial independence (goal #4). Streaming was fun, but extremely taxing in terms of time invested and only the top are making real money (goal #3, #4, #5 violated). Going back to how to identify current passions, none of these are what I think about the minute details of when I have free time. The two subjects that have occupied my mind since 2020 have been gardening and stock investing… but up until now these have been what I would consider to be hobbies. I’ve concluded that it’s imperative to figure out how to make these passions into my “job,” because that is what I believe is my only path to success and happiness. Keeping the passions of the past in mind (now skillsets), and combining these with my newfound passions is the ideal path to creating a job from them (in the way gaming and Chinese led to my job at Intel).

Gardening:

When the COVID pandemic first began, out of sheer boredom I started planting avocado seeds and putting them on our small San Jose apartment patio. Little did I know it was a small action that would guide my decisions over the next three years. When we found out that Michelle was pregnant, the agonizing task of house hunting in California began. Soon the realization came that the only home we could afford was either built before 1950 and falling apart or was a small apartment/condo with no yard. Growing up in North Dakota with a yard to enjoy, I wanted the same for my own children and so we explored other locations and found that we could get a nice house in Arizona for half the price + double the size, and still both work for Intel (the company has a major site in Chandler AZ). We chose a house with a 4/5-acre lot because I wanted to have space to plant trees and for Cora to play around freely in. Ever since moving here I’ve come to love gardening more and more, while learning quite a lot through the experience of managing this large yard and feeling like I wish I could share the pleasure I’ve found in gardening with more people.

In a world with constant literal and figurative noise, gardening is the only pursuit I’ve found that can put my mind at ease. This action allows me to think deeply through ideas and paths to achieve them unlike anything else I can do in my life right now. For example, most of my better proposals while I was still at Intel came to mind while I was in the garden – as were my recent successful stock picks.

Stock Investing:

I became interested in the stock market shortly after joining Intel, mostly because I realized success in it could be corollary to my background and interests… namely technology, geopolitics, and economics. Having always been cautious with money, the hardest part of putting any money I made from my job into individual stocks rather than the products financial advisors touted was simply thinking I wasn’t as smart as those people. Doing an MBA at a top business school changed that. It wasn’t that my education made me smarter or that I realized these people were dumber than I expected. What I did come to realize was what differentiated many of these people was the comfort with and willingness to project confidence and take risks despite ambiguity/uncertainty. This epiphany broke through so much of what I had previously believed and how I had lived my life… being comfortable taking a large risk while being only 90% certain of success now seemed like a no-brainer where it previously would have been something to ponder. As I look back at my life, in general the more calculated risks taken, the better the outcomes. If anything, I should have taken more risks.

Another aspect of stock investing that appeals to me are the clear outcomes. At any time, you can open your portfolio and know how you are doing. Working in a large corporation like Intel you receive feedback from a manager, mentors, and ultimately the amount of compensation received each year, yet how you are doing relative to your peers is deliberately vague in most circumstances. If you want to stay at the same company, you may occasionally (perhaps every few years if you’re doing well) get a promotion – which is the clearest broadly visible sign of success, but between those moments you might get a yearly 1-3% bump in pay and be a “low performer” at the 1% mark but be called a “high performer” at the 3% mark. These percentages are not shared outside the individual manager interaction, and there is an effort by managers to make everyone feel like they are an above average performer to keep them from leaving the team but not need to promote them, even though it’s obvious who is working hard and who isn’t. I would often ask myself, are all the late-night calls and extra hours I put into getting such a small amount more than the person who is doing the minimum worth it? I found this incredibly demotivating, especially in a company that across the board cut pay for everyone regardless of performance.

Clear outcomes are also a similarity with competitive gaming (what I consider my most foundational experience) that I long for. At the end of a competition there is a clear winner and a clear loser, and the winner is generally the person who is better at the game. I feel like ever since leaving gaming I’ve been missing the incredible pressure and motivation that unequivocal public outcomes bring to a pursuit.

Pull the Goalie:

A few years ago I listened to a podcast by Malcolm Gladwell called Malcolm Gladwell’s 12 Rules for Life, which is a deep dive of an essay by Cliff Asness and Aaron Brown titled Pull the Goalie: Hockey and Investment Implications. It changed the way I think about the world. The basic thesis explores the idea of why hockey coaches don’t pull their goalies earlier when the data clearly shows that doing so would give them a higher chance of winning the game. So much of what people (often myself included) are motivated by is minimizing potential embarrassment, not maximizing for the potential positive outcomes - or as Keynes puts it more shrewdly, “Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally.” If I pull the goalie early to maximize the 5 goals previously outlined, what would I do in this stage of life?

Determinative Paths:

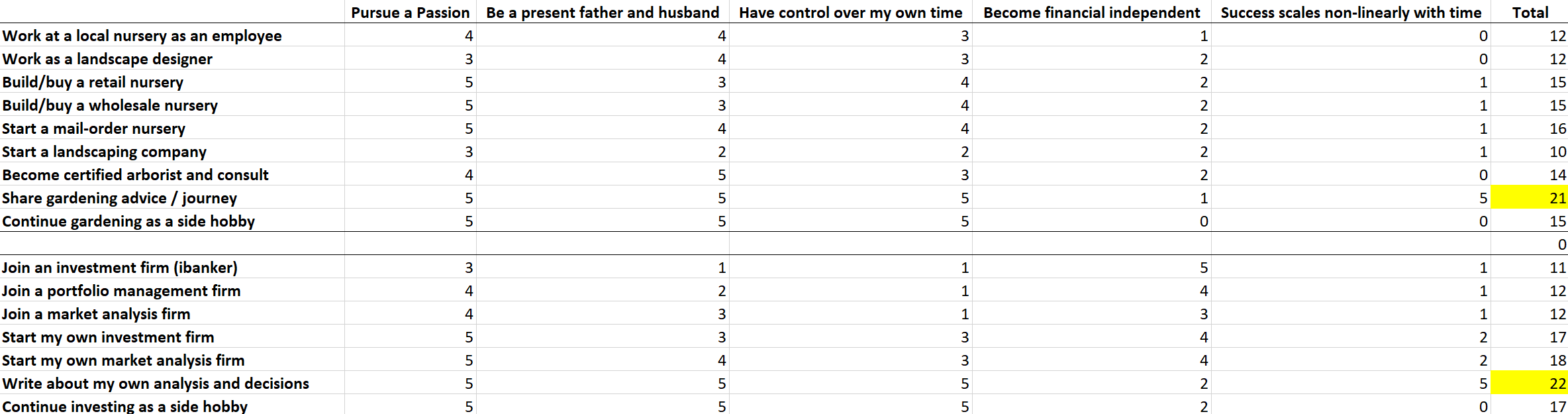

Considering my current passions of gardening and stock investing, I started thinking through all the potential “job” options. With each I cross-referenced these options with how they fulfill my stated goals and tabulated. Factors of 0 being the lowest, 5 being the highest.

What stands out most is the difference goal #5 drives in overall results, and so merits further explanation. If success scales non-linearly (irrespective) of time invested it means that if one does a set amount of work, the financial outcomes can vary broadly. This is the opposite of how most work has traditionally been thought of as it is billed hourly or received through a monthly salary. There have previously been occupations where compensation is highly variable (think of a non-commissioned artist or author not knowing how their work will be received), but the internet has completely revolutionized the possibilities for this way of doing business by eliminating marginal and distribution costs. That is why software companies can be so incredibly profitable if they create a hit – they’ve already done most of the work, so whether they sell 1,000 or 1,000,000 copies of their software, there is almost no additional marginal cost for the massive difference in revenue.

Success scaling non-linearly as a goal began as a part of a previous passion – game streaming. I always had the quixotic idea in mind that if I fully committed to this thing, there’s no limit to how big it could grow. I never fully committed myself, and if I had it likely would have been a failure considering my age and abilities, but the idea of wanting to do something with scale potential persists.

Touch Grass Gardening:

Gardening as a scale business is difficult to envision because by its very nature it deals with the physical. The only path I see that is fully scalable is creating and sharing content (e.g. articles, photos, and videos). Whether you get 10 or 10,000 views, the video is still the video you put out. The other monetizable aspect of this type of gardening business is discovering and selling products that an audience would find useful. This latter point was inspired by a creator (Epic Gardening) in this video where he talks about making $7.3m/year, almost entirely based on products he does not have to deal with himself. The logic being that while you are so enmeshed with an activity it is more likely that you will discover product ideas yet unfulfilled by the marketplace. Having cultivated a community, the creator then has a trusted group which the product is useful for and which he can easily sell directly to. The sourcing can be done by a 3rd party, or in my case I have a background in product sourcing, and it would be relatively easy to build once the product is determined.

Why do a gardening business at all if I’m also planning a business around investing? Losing focus on one or the other is likely to create failure in both, yet I see gardening as integral to the formation of ideas for stock investing and writing about technology, geopolitics, and economics, (the subjects I hope to tackle, and which determine my investment choices). Ultimately, the surest way to failure in investing is to be stuck in front of a computer staring at red numbers all day, while being swayed by the emotions of the crowd. Without being able to step back and disconnect on the most emotional of market days, I can see myself losing the discipline necessary for long-term success in investing. Gardening is integral to that pursuit, and having a business around it will allow for a diversification of the mind.

‘Touch Grass Gardening’ is the name I chose for the gardening company registered. Many people may not have heard of this term, but it has recently been popular in technology/gaming circles as an expression to suggest someone should spend time outdoors and disconnect from technology. I particularly like this definition which states: “When someone tells another person to "touch grass," it is usually meant as a lighthearted or humorous way of advising them to take a break from their online activities, particularly if they are excessively immersed in virtual or digital environments. It implies that the person may be spending too much time indoors or focusing too heavily on online interactions and could benefit from the grounding and rejuvenating effects of nature.” For me, someone who loves technology and often spends excessive time with technology, the name is a perfect encapsulation of the balance required for a happier life.

Dragon’s Den Investing:

The essay that had the greatest influence on my college life was Lu Xun’s Preface to “Call to Arms”. Without going too deep into it, Lu Xun decides that writing (as opposed to medicine, which he had been studying) was the greatest way that he could help his fellow man and potentially change his country for the better. At that time in life, I was going through major changes like many college students do, and I clung to his short stories, and through them writing became something I absolutely loved doing. Writing opened many doors through acceptance into internships, scholarships, and cultivating relationships with mentors/professors. After I graduated college, I stopped writing and regretted it. Writing was one of the activities that I felt truly alive doing, and loved the results it could potentially bring by building ideas into something shareable. It might be the height of arrogance and delusion to think people want to read my writings, but there’s only one way to find out.

Writing about investing appeals to me not because I am obsessed with the intricate financial calculations and acronyms you normally see in stock analysis (most of these are already priced into a stock), but because the subjects I find most interesting and follow most closely (technology and geopolitics) bear such importance to today’s business and investing. So, my actual writing interests are the precursors to the action of stock investing, but thinking and writing alone are not as exciting as putting these ideas to the test through a bet with my own resources.

My stock investing method is to lean on my areas of expertise in technology, geopolitics, economics, and business strategy to identify broad trends, then spot companies that will most likely benefit from these trends. Once a handful of promising companies are filtered, research each to the best extent possible, filter further, and then follow them closely while watching the price for months to understand its trend. When a 52-week low or close enough to it for reasons that do not make sense to me occurs, I see this market panic/fear as an opportunity to buy and will place a significant bet based on the fundamentals researched and trends identified. I generally only make a few trades on individual stocks per year, but each made with significant portions (10-25%) of my portfolio. My fundamental conviction aligns with Warren Buffet’s maxim that diversification is protection against ignorance.

The question of whether this could be a scalable business is based on whether anyone would find my methods and what I have to say interesting. I don’t have the credibility or track record to attract capital from others (to start my own fund and charge fees by investing other people’s money), so what I am left with is showing my own portfolio and sharing my analysis on decisions I’ve made, trends I see, and what I am considering doing in the future. The logic being that if I am successful, then hopefully I can build a community while also building towards the prospect of creating my own fund by showing credibility over time through a track record of performance.

I see several paths to monetization:

1. Return on my own investments (optimistically more than in past now that I am more focused)

2. Subscribers to my writings (e.g. Substack, X, Patreon, etc.)

3. Paying a 3rd party to build software that would be useful to my community (e.g. a portfolio tracker or a way to track mine as a comparison point and give advice for their own)

4. Tiering access to writings, advice, and access if valued by audience (e.g. as I/O Fund does)

5. Opening my own investment fund with outside capital (minimum 5+ years track record, contingent on significantly beating market averages and building trust)

Building trust requires transparency. One of my biggest lessons from working at Intel is that a lack of transparency within a company (or community) is corrosive to trust and to an overall culture. So, whatever I do I want to be fully transparent and build with this in mind. This requires getting over a bit of squeamishness in showing my own finances and my own failures. Yet being an open book is one of the market niches I see for readers to potentially find attractive. Most everyone I follow who talks about their investment decisions will generally be vague about what price they bought a stock at or how much they still hold relative to what they bought (selling at the right price is even harder than buying at the right price). Additionally, almost no one talks about their embarrassing failures. Failure is learning, and if there’s anything that devoting 15+ years of my life to learning Mandarin Chinese has taught me is that progress requires embarrassment.

Why would I think I could possibly beat the stock market average? Very few individual investors do, and those that do consistently year over year are generally thought to be only 5%. Firstly, I think technology and geopolitics will play outsized roles in the market in the coming years, giving me an advantage over most. Secondly, the stocks I’ve picked over the past few years have been strong market beating performers. This short-term success could be just dumb luck, but I have at least enough indication that it’s worth vetting my skills and methods further.

Most investment companies/funds have some kind of amorphous name that is meaningless if you don’t already know what they do. This is deliberate to protect from any perceived bias, but for me I want to choose something more personal and descriptive. So why choose the name “Dragon’s Den Investing” for the business? Two main reasons other than that I think it’s a cool name that may strike some kind of intrigue when read:

1. When I was young, the first video game I played that was deeply impactful to me was called “Dragon Warrior.” It involved a solo journey of adventure through the world facing all types of challenges and difficulties while growing stronger over time. When difficulty befell my own life, I would often rationalize it through the lens of this game’s story where it was just an experience on the road to my eventual destination, and that experience would help make me stronger to get there.

2. I found a furtherance of this basic idea in a parable by Nietzsche called “The Bite of the Adder” in Thus Spake Zarathustra: “One day had Zarathustra fallen asleep under a fig-tree, owing to the heat, with his arm over his face. And there came an adder and bit him in the neck, so that Zarathustra screamed with pain. When he had taken his arm from his face he looked at the serpent; and then did it recognise the eyes of Zarathustra, wriggled awkwardly, and tried to get away. "Not at all," said Zarathustra, "as yet hast thou not received my thanks! Thou hast awakened me in time; my journey is yet long." "Thy journey is short," said the adder sadly; "my poison is fatal." Zarathustra smiled. "When did ever a dragon die of a serpent's poison?"—said he. "But take thy poison back! Thou art not rich enough to present it to me." Then fell the adder again on his neck, and licked his wound.”

The ideas expressed above helped me through bad times in the past, but also taught me to be thankful for the “bites” that happen in life because it can change your perspective and wake you from a slumber. The past few years have been a race to just get through each day, but being fired from Intel has allowed me the time to reset and think about what would make me happiest in life right now. I am enormously thankful for that.

A Conversation with Doubt –

Doubt: So, you are going to be a house husband with a blog and a Youtube channel? I can hardly think of something more pathetic. Can we call this a mid-life crisis yet?

A: It does feel like when as a college junior I told my family and friends I was quitting competitive gaming to go to China, which was a crisis of sorts. It turned out to be the best decision of my life. I do think this is a personal and professional crisis, and so a drastic change is needed. My family will be happier and I will be happier. Success beyond that is less important and TBD.

Doubt: Are you just giving up all the time you’ve invested in Chinese? Gaming? A potential career path in the corporate world? Why are you just throwing it all away?

A: I think everything I’ve done before has led to this moment, and my writing and investing abilities will be all the better from these past experiences. If both business ideas fail to gain traction after several years, I presume I may have the motivation and financial pressure to go back into the corporate world to utilize previously developed skills.

Doubt: These business ideas are likely going to fail, and even worse they will fail publicly… scale businesses have the potential to be so successful because they are more likely to never be noticed or gain traction.

A: I’d say each business has about a 10% chance of monetary success. The low chance of success is something I find motivating and appealing, and moreover whether it ends in success or failure - this is an adventure that I can call my own.

Two things came to my mind after reading this great piece of yours. 1/ “人无远虑,必有近忧“, or "If a man takes no thought about what is distant, he will find sorrow near at hand", which is a ancient piece of wisdom from Confusion Analects. 2/ “活在当下“, which I suspect is best translated to Carpe Diem as what you had in the article. It is so hard to balance between biased for action for the Now and patiently planting the seeds with an eye on the Future. What you have in this writing gives me a good framework on this tricky topic—thank you! And good luck on your new journey!

Leaving Intel to go to a startup where I was only paid in equity felt like a huge leap that risked a lot of the upward career trajectory I had invested in for so many years. It was an amazing change and I loved the early stage startup life. 2.5 years later I left that startup to grow my own startup and it felt like another big risk, but a step in the right direction for my personal career journey, similar to you. Now, it's hard to imagine ever working for someone else again. Not that everything's easy, by any means, but it's mine to make or break, along with my co-founders and the rest of the team, and it's super fulfilling.

I believe there's pretty much always a way to monetize things if you create good value that people want. Content businesses can take awhile to gain any real traction, AND they can turn into phenomenal flywheels with outsized returns (Content Inc. is a great read if you haven't yet read it) for those persistent enough to get there. I'm not interested in gardening, and somewhat interested in investing, but I'm always interested an entrepreneurial journey and wish you the best in it!