Discover more from Dragon's Den Investing

Intel Earnings Pushes the Stock Down 12%

The Curse of High Expectations and a Look Into the Future

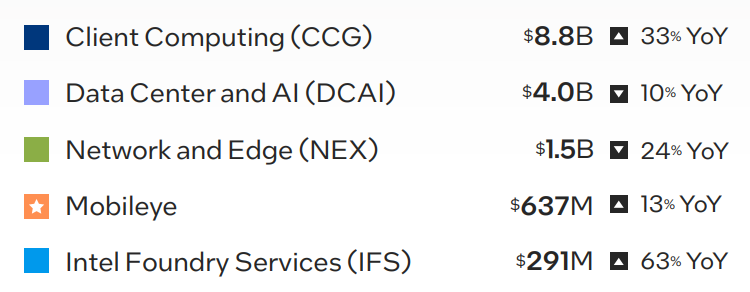

Intel (INTC -0.05%↓) announced Q4 earnings Thursday, beating expectations on the past quarter, but disappointing guidance on the next. Within minutes the stock dropped -6% and hovered there in after-hours trading. Disappointingly for Pat Gelsinger (Intel’s CEO), his comments on the conference call shortly thereafter only further tanked the market’s confidence in Intel and the stock opened the next day down -12%.

There are two primary reasons for the extreme pullback:

AI trends and those who profit from it — why not Intel too?:

Investors assumed Intel would be able to ride the AI compute wave to some extent, or at least the company’s executives have been telling the market this is the case. Unfortunately (on the data center side) it’s quite the opposite as the DCAI business unit’s revenue was down double digits and guidance is that it will continue to be down double digits next quarter. They are precipitously losing share of wallet spend on data center to Nvidia and AMD. This is quite a disaster and shows no signs of abating. Investors assumed Intel would show some AI accelerator revenue, but it should now be abundantly clear that Intel’s data center offerings are so uncompetitive against Nvidia, AMD, and CSP (cloud service provider) designed silicon in the AI data center revolution, that customers are not even considering Intel in the option set.High expectations based on current market trends — (stock was +88% in 2023).

Intel’s stock was up irrationally high from 2023 lows, and was primed for correction unless there was some unknown surprise to the upside. Investors in Intel should take solace in the fact that not that much has changed in the numbers, but the stock is still up significantly from its lows of ~$25. Stocks assumed to benefit from the AI boom have generally done well regardless of the revenue they have shown related to AI, yet as I wrote in my market outlook and framing on 2024, this year will be largely defined by show me instead of just tell me in relation to AI (as it was in 2023).It should also be said that Intel has been disappointing the market on earnings days almost to a habitual extent, especially since Pat Gelsinger took the helm. He has a history (both internally and externally) of over promising and marginally delivering. This isn’t necessarily a bad strategy for him, and perhaps it is clever since it’s very hard to run a company or sell his strategy to the market if he is always gloomy about the gargantuan job it is to turn the heavily barnacled Intel ship around. I am a supporter of Gelsinger, and I think he is one of only a handful of people in the world who has a chance of fixing Intel, but as investors in the company we should expect these types of radical swings to continue. It is no easy feat to reshape a company historically known for its own product designs, marketing, and manufacturing into a manufacturer primarily for others.

Glimmers of Light:

From the moment I joined Intel in 2016, it was driven into employees at the company that the future of the business was outside of CCG (client computing group, the unit that makes silicon for PCs). Investments were primarily made in other newer seemingly fast-growing groups with significantly less revenue, and much of the ambitious talent within the company preferred to work outside of CCG. It is then ironic, and also a brutal indictment of the performance of those executives outside CCG, that this group is now the only bright spot within Intel. In some sense, the company is desperately clinging to the revenue CCG brings in so that it can fund its long-term transition to a pure play foundry. Without CCG, these foundry ambitions would need significantly more funding from outside sources, and likely the company would more seriously be contemplating splitting up. As an investor who is betting on Intel’s foundry because of the geopolitical and technology trends I see, as long as CCG can continue to maintain revenue growth, I am less worried about the long-term prospects of this transition. Of course I would love to see growth in the business units that the market cares more about, but until then (and don’t hold your breath), expect more periods of short-term pain in the stock as executives say AI in every sentence but fail to show AI revenue.

Divining the Future:

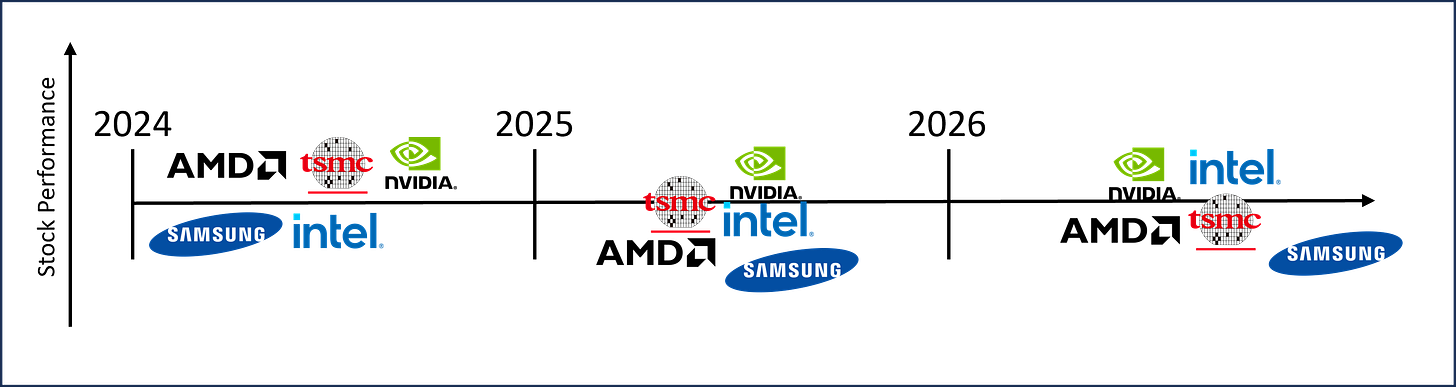

It is impossible to predict the future, but we investors try our best. As for the now very hot semiconductor space, I have a general view that can be illustrated in an oversimplified manner by taking for our purposes the two most important AI silicon design companies (Nvidia and AMD), and the three most important foundry companies (TSMC, Samsung, and someday Intel).

My views are shaped by geopolitical and technology trends, namely the below:

Short-term Nvidia and AMD will ride high on the AI wave (2024), as they are the only true data center GPU players. Customers will continue to scramble for GPUs, and TSMC will benefit as the main foundry for these products.

The giant tech companies like Microsoft, Apple, Google, Facebook, etc., will be increasingly designing their own silicon to compete with Nvidia as they loathe the cap ex and margins Nvidia charges. You can see another example of this from last week with Sam Altman’s quixotic quest to create his own silicon manufacturing, but the big tech firms have been working on this for many years. This eventuality will squeeze both Nvidia and AMD in 2025+, but benefit the foundry companies. AMD margins will suffer more because they go from 2nd choice to 3rd choice.

China will not invade/blockade Taiwan before the 2024 US election, but the probability increases significantly thereafter (see War in the Taiwan Strait). TSMC and those customers who run their entire product lines in Taiwan look to be increasingly risky. This will benefit Intel in 2025+ as shareholders and board members will require alternatives to TSMC’s leading edge process which will be kept in Taiwan. TSMC’s foundries outside of Taiwan will not ramp properly or have the same success as facilities within Taiwan because of stark cultural differences.

Samsung as a foundry is struggling, and will continue to do so as the foundry business is very hard to run as a side business. Samsung will also suffer greatly from a Taiwan conflict because shipping lanes and airspace will be increasingly difficult to navigate and insure for this region. The country could also foreseeably be forced into the conflict on the side of Taiwan as it is a US ally and houses ~30,000 US troops. Samsung is investing mostly in South Korea, so they do not have the diversification of geography that would allow a hedge against conflict.

Intel will benefit in the long-term if they can execute and earn the trust of customers (no small feat). On the Intel calendar there is a much hyped foundry day next month, which could be a sign of who is testing Intel’s newest processes. If Jensen Huang or Lisa Su were to give Pat Gelsinger even a handshake or a short speech at this or other upcoming events, it would be a huge boon for Intel. I don’t expect this next month, but in 2025? Probably.

So Why Hold?

If Intel’s strategy is set to blossom in 2025 and beyond, then why hold the stock in 2024? I wrestle with this question, and frankly regret not selling when the stock hit $50 in December 2023. I had expected at least a modicum of product momentum in AI accelerators for the data center group in the earnings call last week, but sadly none was to be found. If the stock creeps back towards $50 in the first half of the year, I will likely sell. If it stays depressed into the second half of the year, I would then favour holding to see through the long-term strategy into 2025+. There’s certainly no guarantee that Intel will be able to execute on customer demands that are accustomed to the rigour of TSMC, but I feel very strongly about the geopolitical and technology trends that are in Intel’s favour long-term. Until then, long-term holders of Intel stock should avoid listening to their quarterly earnings calls.

Subscribe to Dragon's Den Investing

Writing about technology, geopolitics, and stock picking. Ex Intel Corp individual investor sharing portfolio with full transparency.

I think raja created lot of mess by creating separate data center gpu product vs using gaudi as baseline and build over that. Having two data center gpu product with separate software stack is recipe for disaster. I think intel might have chance to get data center wins if they release falcon shores with good software stack.