Discover more from Dragon's Den Investing

First Stock Purchase of 2024 - Occidental Petroleum ($OXY)

A Play on Geopolitics and Counter-intuitive Technology Trends

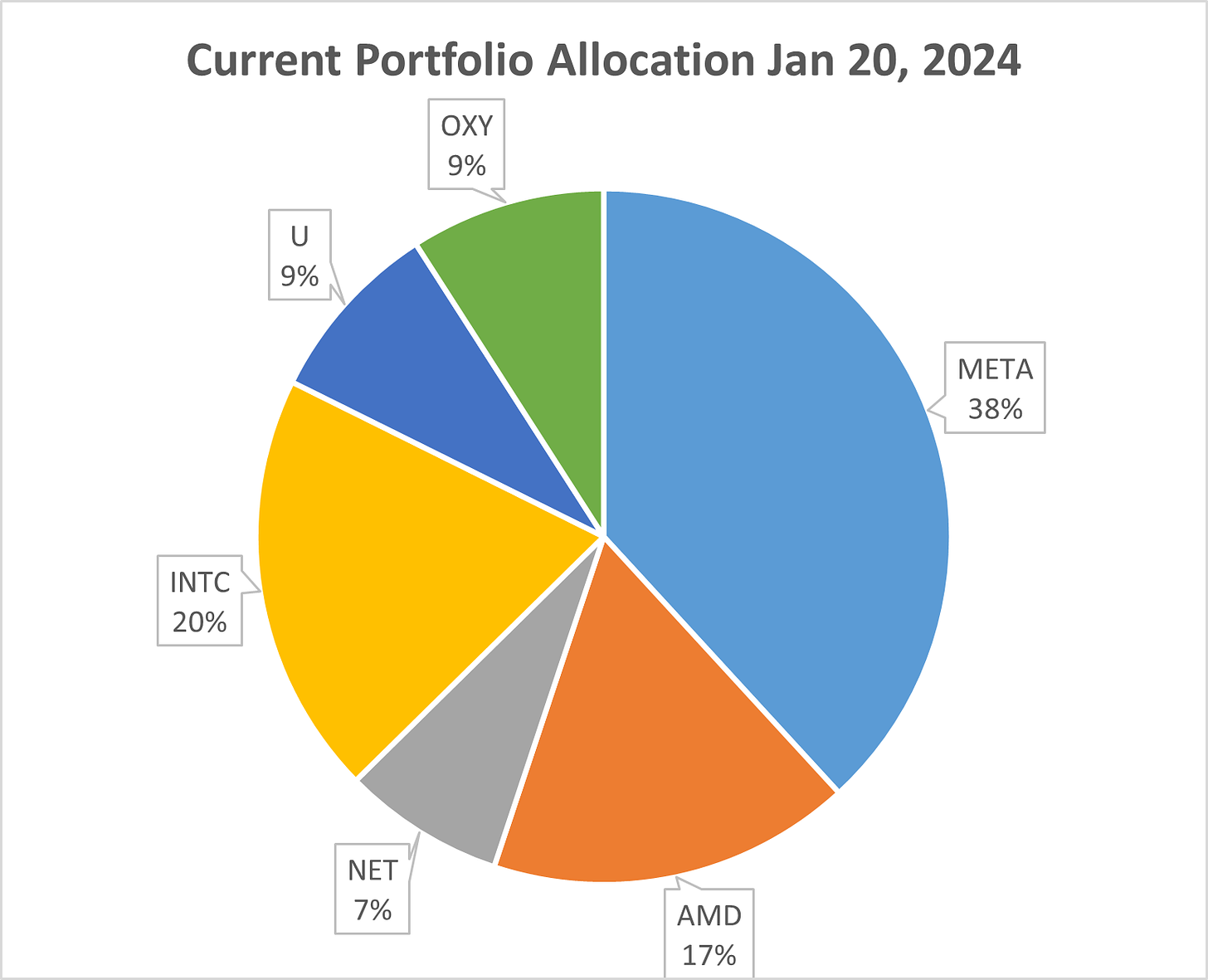

Last week I wrote in my outlook and framing on 2024 that semiconductors would be one of the big winners, and strangely enough we did not have to wait long to see this trend — over the week NVDA -0.12%↓ was up 9%, and AMD 0.00%↑ 18% (my portfolio consists of approximately 17% AMD). It might seem counter-intuitive then to now buy into an old technology that has seemingly little to do with the popular trends of the year; but this week that is what I did by buying Occidental Petroleum (OXY 0.00%↑).

One of my fundamental investment philosophies is that the best opportunities present themselves when few are talking about them, or even better when consensus commentators are talking about them in negative ways (e.g. see my META -0.15%↓ buy framework for Nov 2021). Of course whatever the prevalent sentiment is will then be reflected in the stock price, and a disciplined investor with a robust thesis and patience will be rewarded in time by buying when few are saying to do so. When every stock market observer and commentator is talking about AI, I think that’s a great time to hold and/or think about selling those stocks, but it’s likely not an ideal time to buy unless an individual’s beliefs go beyond the consensus of the market (my AI beliefs are strong, but not so much that I would buy in at these prices).

“Kiddo, We’re Going to End Fossil Fuels”:

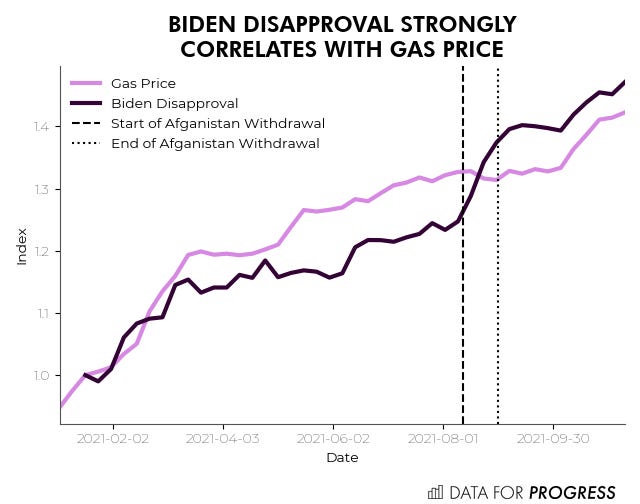

My interests in oil and gas as an investment were first piqued when gas was $5 during 2021-2022, and the Biden administration made the choice of tapping the strategic petroleum reserve to lessen the burden on American gas prices before a mid-term election. Clearly the gas price was so politically important that even a president who campaigned in 2020 on “ending oil,” felt such political pressure that he was forced to draw into oil reserves meant for a time of war just to marginally lower the price for Americans. In retrospect, Biden’s move was a masterstroke, and gas prices became less of an issue in the 2022 election. We can see from multiple studies that a president’s approval rating ties closely with rising gas prices, even when the consensus political beliefs of one major party lean towards thinking oil/gas is an old and dying technology.

Finding the Dissonance:

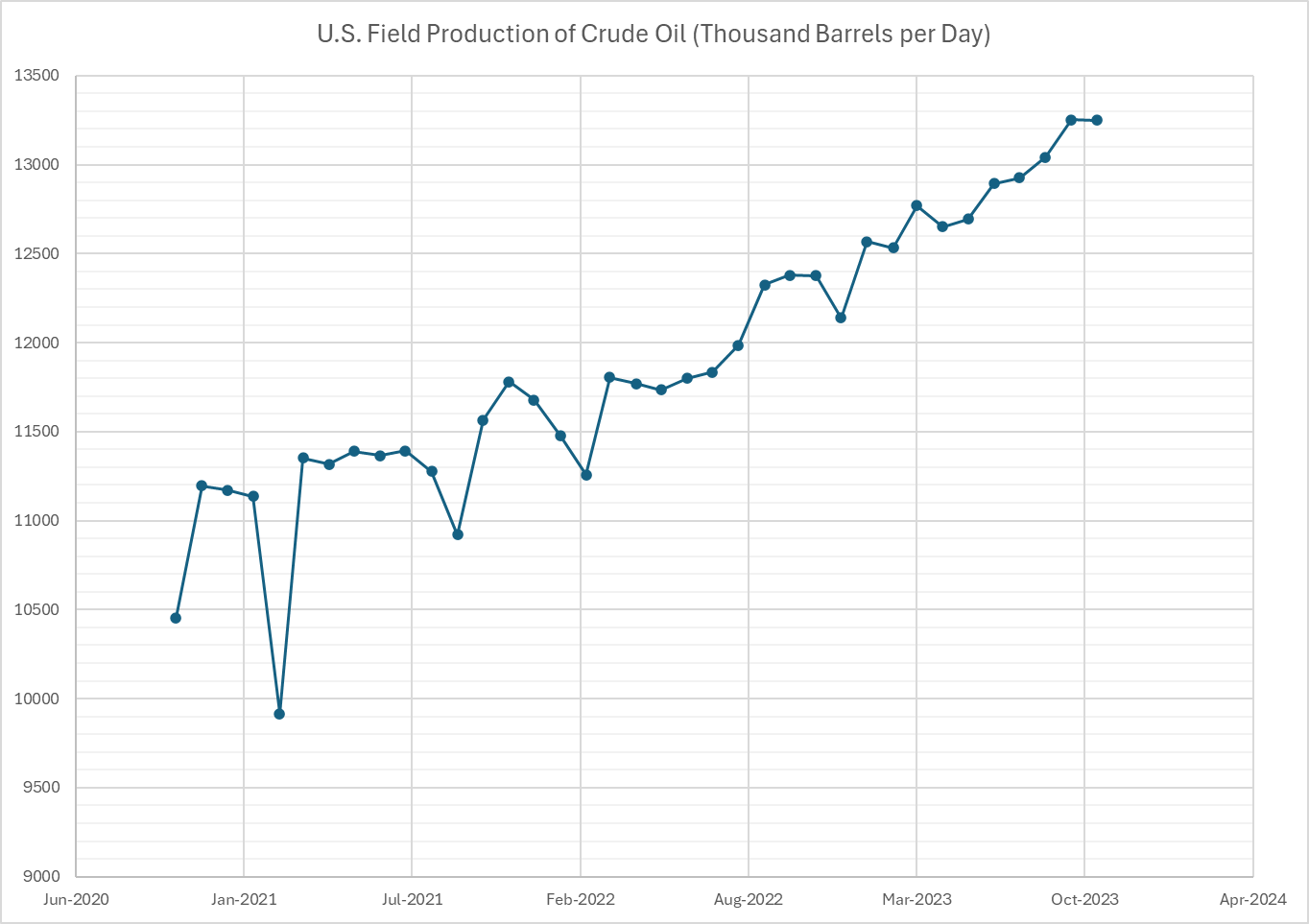

It is apparent (mostly for noble reasons) that the stated goal of many politicians and technology business leaders is to “end oil,” but there seems to exist a large disconnect between their aims and reality. Demand for oil globally continues to rise; oil production in the United States is at a near-term high (this will continue at least through the 2024 election); and the Middle East and Russia (top producers) are powder kegs where matches are being thrown around daily. These reasons alone would be enough for many investors to at least give American producing hydrocarbon companies a second look, but most of the stocks have hardly budged in the last year (for instance OXY 0.00%↑ is down 15%, and most others are down 10-20%).

One of the notable investors that has bought into American oil and gas is Warren Buffet and the late Charlie Munger’s Berkshire Hathaway, which has considerable positions in Chevron CVX 0.00%↑ and Occidental Petroleum (and recently upped their share of OXY 0.00%↑ to 34%). Their fundamental belief is that oil will be more important to humanity in the future than what the consensus believes, and so hydrocarbon companies which own assets that will produce into the future are worth investing into now (for OXY 0.00%↑ that’s the Permian Basin). This sentiment was recently echoed by Occidental’s CEO Vicki Hollub, who said there will be a disconnect between supply and demand for oil in 2025 and beyond. My view is that this makes logical sense, but to invest now felt right because of the many other factors at play that should move the stock price before having to wait half a decade.

A simplified list of factors which I believe play into hydrocarbon stocks being a reasonable investment in the short/mid-term:

Elections throughout the world in 2024 incentivize incumbent leaders to run their economies hot, thereby supporting the demand for oil.

China’s economy is suffering greatly, and will likely require some sort of stimulus to get back on track. China is the largest importer of oil worldwide.

Global GDP growth in the coming years is forecast to occur mostly in lower-middle income countries such as India and much of Africa. The low GDP per capita in these countries will require cheap energy (fossil fuels) for them to grow, as much of the newer battery and clean technologies are comparatively more expensive. The efforts at the UN and other climate summits to have rich countries subsidise clean energy solutions for lower-middle income countries will go nowhere because of the internal politics of richer countries.

The Middle East conflict is escalating, and I see no end in sight. This region accounts for 33% of worldwide oil production. Oil is generally priced from a worldwide standpoint, so if it costs more to export oil from Saudi Arabia or Iran because of an ongoing regional conflict, this allows US producers to charge more.

Because of political pressure on hydrocarbon businesses and social movements like ESG, capital expenditure (investments in oil exploration and the like) are down massively, yet clean energy sources are not yet scaled to the extent that they can fill the gap left by a lack of new investment in oil and gas. Goldman Sachs puts it this way:

We believe that the energy industry has been under-investing since the peak of 2014, with investments in traditional energy (oil, gas upstream) falling 61% from the peak and driving a 35% reduction in global primary energy investments, from US$1.3trn in 2014 to US$0.8trn in 2020.

The demand for EVs / clean energy products is not meeting supply, and many companies such as Tesla and Ford have had to drop prices or cut production in response. I found this deep dive into why Hertz is selling off its Tesla fleet particularly interesting in showing why both sentiment and infrastructure is not ready for the clean energy revolution in the US. If even giants such as Tesla and Ford are needing to take such drastic action, a whole bunch of EV and clean energy companies are about to go bankrupt.

But Why Now?

Over the past 5 years OXY 0.00%↑ is down -15.2%. My best investment thus far in the same timeframe is AMD, and that is up +694.5%. One might look at this performance difference and scoff at the idea that such a stock as OXY 0.00%↑ warrants attention. From my point of view, timing is extremely important in this type of scenario, and for picking individual stocks in general. While the core thesis from Berkshire is likely to come to fruition in 2025 and beyond, the above 6 factors I gave were not true 5 years ago when Berkshire first bought the stock, and so the timing now seems more correct to me. As for the role of price, would the timing seem correct if the stock were up considerably from 5 years ago? No, because that would imply that the core thesis and assumptions are now priced in.

In general, if one is investing into the stock market through index funds or broad diversification, it should be done without consideration for timing. If on the other hand, one is picking individual stocks based on price, technology, and geopolitical trends (as we do here), then timing is incredibly important to our success because the portfolio itself contains so few investments but all at a much larger percentage of our overall net worth. Having AMD 0.00%↑ or NVDA -0.12%↓ in a portfolio today makes the investor look smart because the stocks have done so well and he can say he owns them, and thus many will buy at whatever the price may be. Who could fault someone for buying more AMD or NVIDIA today? Yet a fund manager buying into oil in 2024 could be viewed as exceptionally moronic if the investment doesn’t pan out. For someone like me who doesn’t care about perception but only performance and following my own point of view, I couldn’t help but love the idea of buying this stock now — a true feeling of pulling the goalie early despite potential embarrassment.

Portfolio Implications and Miscellaneous Questions:

Q: Rather than buy OXY 0.00%↑ would it make better sense to put more money into META -0.15%↓ if that is your highest confidence stock in 2024?

A: Possibly, but the tech bull market has already occurred to such an extent that I feel the comparative opportunity with Occidental is within the same range. Additionally, META -0.15%↓ is such a large percentage of my portfolio after the gains of last year that I do not think investing further into it at 4x the price I paid is a wise course of action.

Q: You don’t know much about the oil and gas industry, this seems quite a stretch.

A: Indeed, but people I trust and who have done the due diligence do (Berkshire). There is no doubt in my mind that the fundamentals are sound based on my understanding of their vetting process. Still, Berkshire’s thesis alone was not enough to cause me to buy into OXY 0.00%↑, but with the addition of the geopolitical and technology trends I see (without these yet being priced in) was enough to push me into this decision. Additionally, an investment strategy I quite like is where one is cognisant of one’s own ignorance on a topic but observes someone highly trusted and respected buying into a stock, agreeing generally with the thesis but adding their own on top of it, then waiting for the stock to be priced at ~10% less than said highly trusted/respected person bought it for. This is a strategy I used with Cloudflare NET 2.05%↑, and today that stock is up over +100% from where I bought it a little over a year ago.

Q: Why OXY 0.00%↑ instead of some other oil company?

A: The most obvious reason is that the CEO seems more competent and straightforward than leaders of other oil companies. The less obvious reason is that OXY 0.00%↑ has higher profit margins, a concentration of assets in the United States, and that these assets are forecast to last for a long time (fulfilling Buffett’s thesis over the long-term). I must admit that my ignorance of the oil industry led me to lean on Berkshire’s expertise on the core fundamentals of which company to pick. Funnily enough, in interviews Buffett also claims complete ignorance of the oil and gas industry, but that has not stopped him from investing or building a thesis.

Q: How will this affect your portfolio allocation? Have you given up on tech at these high prices?

A: Not at all - tech still is 90%+ of my portfolio. I just happen to see this as a unique opportunity and timing. My focus will continue to be on technology, but obviously geopolitics is an important factor in how I think about investing, and 2024 is a year where I think geopolitics will play an outsized role in the stock market.

Q: How long do you plan to hold OXY 0.00%↑ ?

A: As with all investments I make, I plan to hold at least one year as to not pay short-term capital gains taxes. If I think the thesis to buy a stock requires selling the stock in less than a year’s time, I will not buy it. Likely this is a hold over the long-term as Berkshire’s thesis comes to fruition after 2025. I will revisit price and thesis in one year.

On the Morality of Owning Oil and Gas:

I generally believe that nearly every moral issue is complicated, and that on most I can understand perspectives from both sides. As for my own stance on owning oil and gas, I think the industry as a whole does more good than harm for humanity in its current state (as Buffett and Munger have said as well). Furthermore, if we were to focus on American owned oil and gas companies (such as Occidental), I could go so far as to say it is morally good in that it allows the US to not be beholden to oil rich dictators and strongmen who would coerce and do harm through their control of hydrocarbons if such American industry were not in existence. Lastly, if someone with an individual portfolio as small as mine has the hubris to think his investments will alter the shape of global financial capital based on a small allocation, he likely is someone not worth listening to on investment or other matters altogether.

Subscribe to Dragon's Den Investing

Writing about technology, geopolitics, and stock picking. Ex Intel Corp individual investor sharing portfolio with full transparency.